Hey reader! If you're new here, you can check out all the previous issues and subscribe here, so that you don't miss a single mail. You'll get a free PDF on getting the perfect credit score when you subscribe:

Home affordability is now at its worst since the stagflation era of 1981, after the US got rid of the gold standard.

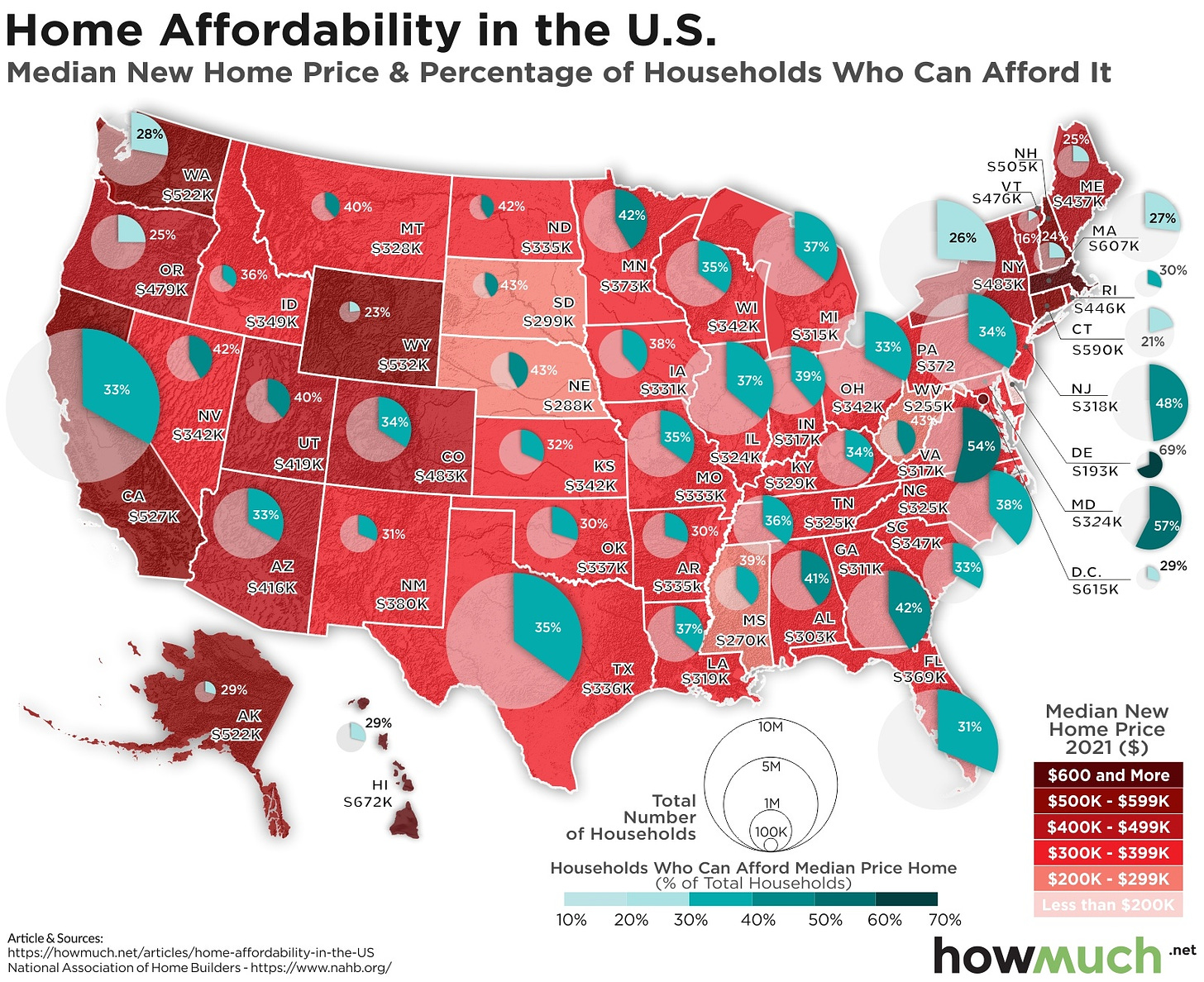

A home is considered affordable if the monthly cost is less than 30% of the area’s median income – but currently, 38.6% of the median household income is required to meet monthly payments, as per CNN. As a result, housing in 99% of the United States is unaffordable for the average American making $71,000 per year.

With rising mortgage rates, the average home buyer who needed $75,969 in income per year to afford the average home now needs to make $107,000 – though incomes have not gone up by $31,000 YoY.

With housing prices pulling out of the reach of the typical buyer, the White House is proposing some brand new changes including:

- Mortgage Relief Credit up to $10,000

- Seller Tax Credit

- Down payment assistance

- Cheaper refinancing

- Incentives for developers to build more homes

- Rental relief

Some of these are going to really help, while others will have long-term consequences. Here’s what you need to know as a buyer, seller, real estate developer, or just someone who is part of the housing market by default by living in a home in the US. Let’s go through the facts and see what you need to come out ahead:

Relief for Buyers and Sellers

The White House issued an official statement calling on Congress to pass a mortgage relief credit. This would provide middle-class first-time homebuyers with an annual tax credit of $5,000 a year for two years, effectively reducing their mortgage rate by 1.5 percentage points or more for two years on the median home, helping “more than 3.5 million middle-class families purchase their first home over the next two years.”

But the plan falls short in so many ways. If you were going to buy a house anyway, the tax credit is nice – but this shouldn’t be the reason to buy a house or “push you over the edge”. The tax credit only subsidizes two years of interest rates, and then it’s going to be the full cost of ownership paid for by you. While it’s likely that rates will drop and you can refinance:

- It’s not a guarantee.

- Rates could remain identical to where they are.

- It could cost a lot of money to refinance.

From a recent breakdown that CNN published, average refinancing costs range between 2 and 6% of the entire loan balance. With a $200,000 mortgage on a starter home, you’re looking at anywhere from $5,000 to $12,000 to lower your rate, wiping out the upfront “tax credit” you received. While this might benefit people who were going to buy a house, regardless of market conditions, this isn’t a realistic way of driving more demand during a time when the market is suffering from an inventory shortage. This continues into the second part of the proposal – a seller tax credit.

To attack the supply problem by bringing in more inventory, sellers have to be incentivized to give up their homes – a tough task because they’re already locked into homes with mortgage rates. So they also propose giving “a one-year tax credit of up to $10,000 to middle-class families who sell their starter home, defined as homes below the area median home price in the county, to another owner-occupant. This proposal is estimated to help nearly 3 million families.” For 88% of the country, homes under $350,000 would qualify under this definition. But there are three problems with this.

- Sellers will be forced to pay a higher interest rate when they buy another house.

- They will have a higher property tax basis, since – nearly guaranteed – they’re paying less than market value.

- The sellers need to move somewhere – so juggling around existing inventory without adding to the supply is likely to be a wash.

It might also be difficult to fulfill the condition that the home should be sold to an “owner-occupant” because some sellers have neglected maintenance and upkeep for a long time. Unless a future buyer wants to do a lot of work, it might just be sold to an investor, which wouldn’t let you qualify for the $10,000 credit. For people looking to sell their homes anyway, this proposal is great, but for someone who’s on the fence, this might not convince them to let go.

Dangerous Precedent

The third part of the proposal is down payment assistance. This is the one that seems the most scary to me. The proposal says,

“The President continues to call on Congress to provide up to $25,000 in down payment assistance to first-generation homebuyers whose families haven’t benefited from the generational wealth building associated with homeownership. This proposal is estimated to help 400,000 families purchase their first home.”

Down payment assistance is nothing new. There are programs out there that you just have to find. For example:

- Nevada offers a $25,000 forgivable down payment to eligible homeowners purchasing a primary residence anywhere in Rural Nevada. This is structured as a second loan with zero interest and no payments, and it’s forgiven in 3 years.

- Joe Biden’s 2021 Down Payment Act was also revised to create “The Downpayment Toward Equity Act of 2023” and included down payment assistance of $25,000 like the latest proposal. But since 2021, it’s been sitting with Congress, not yet passed by law.

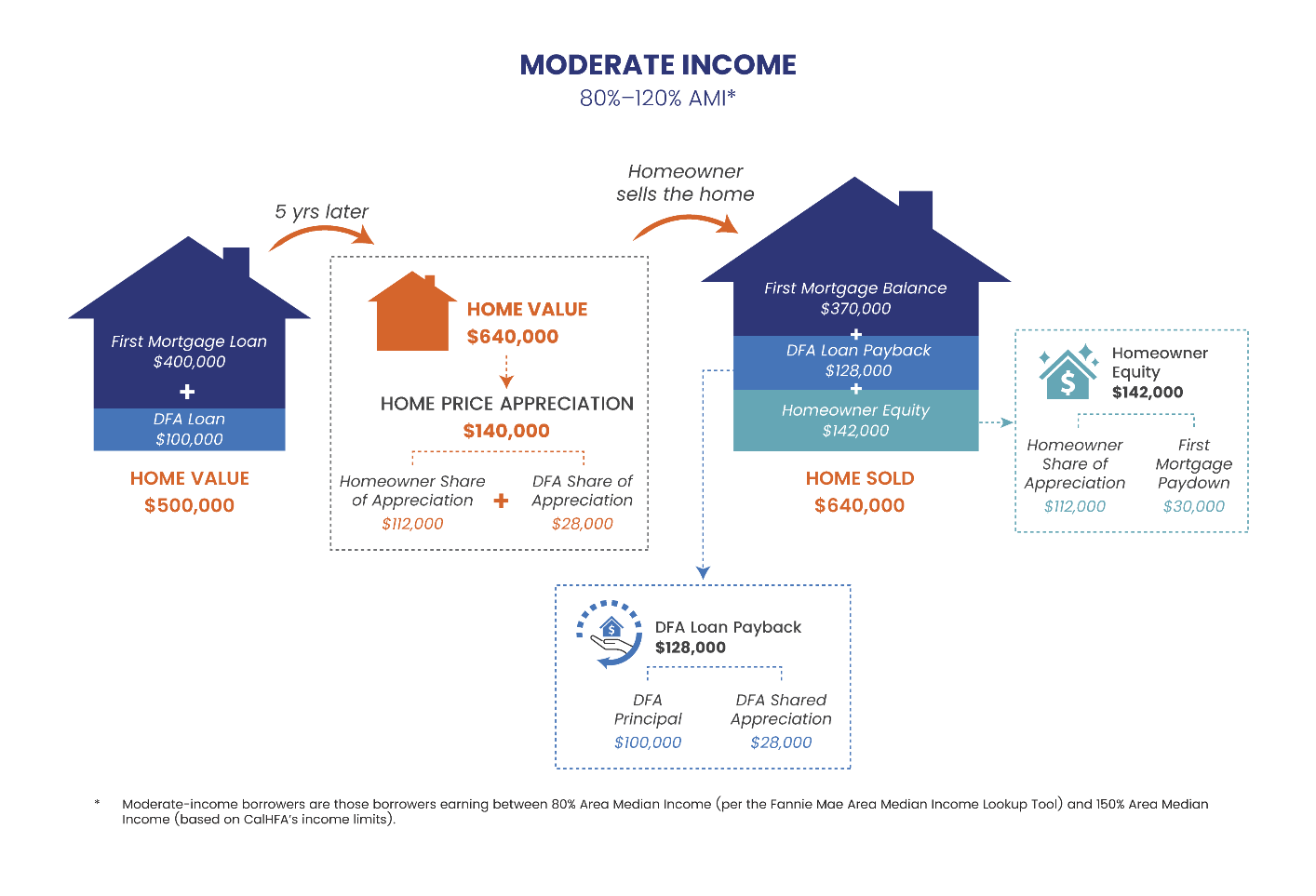

- On a state level though, there are other programs, like “California’s Dream For All Shared Appreciation Loan” (what a name). This program introduced a year ago gave first-time homebuyers a 20% downpayment loan on their first property, and after they closed, the new homeowner would pay back the original loan amount plus 20% of any appreciation once the home is sold.

The program was so popular that the entire $300 million dollars was gone in 11 days! With 2300 borrowers currently approved, that’s an average of $130,000 for each and every person, at a time when real estate is its least affordable. If you think that would make them reconsider – nope. They’ve brought it back in 2024, with a few more qualifications, similar to the White House’s plan:

- You must be a first-generation homebuyer

- You must make no more than 120% of the area’s median value (less than 150% in the year prior)

- A credit score of 680, and a debt-to-income ratio of 45% or less.

I’m concerned that down payment programs like this set a dangerous precedent – sure, it helps people buy their first home – but if the state subsidizes down payments without addressing the problem of supply, housing prices will continue to rise. And with the state entitled to a 20% share of the profit, there’s a financial incentive for the state to not let housing go down.

Existing homeowners are the only real winners here, because now there are 2,000 more buyers in the market that didn’t exist before, and this just increases demand without increasing supply. Now that we’ve got the purchasing aspect out of the way, let’s talk about loans.

Refinancing a mortgage can be very expensive. The proposal aims to make refinancing cheaper by waiving

“the requirement for lender’s title insurance on certain refinances. This would save thousands of homeowners up to $1,500, and an average of $750, and the lower upfront fees will unlock substantial savings for homeowners as mortgage rates continue to fall and more homeowners are able to refinance.”

Title insurance companies are so profitable that they pay out just 3 to 5% of their premiums to consumers, compared to 70% in other types – so the time is ripe to reduce their fees. Plus, the proposal will also extend throughout closing costs (which can be absolutely absurd and can stack up to thousands of dollars). It isn’t clear yet what they plan to do and how much this will really make a difference. Now, let’s talk about the supply side.

Relief for renters

Development is expensive, risky, and time-consuming – and generally makes sense only for luxury projects, which explains the lack of supply. But one measure of the proposal would “pass legislation to build and renovate more than 2 million homes, which would close the housing supply gap and lower housing costs for renters and homeowners.” This would give tax credits to those who build or renovate low-cost housing.

If you’re a developer, you’d need to invest in a project for at least 2-3 years and build with a profit margin to make the development worth it. To make the project a safe bet, developers build as much square footage as possible to maximize the price point and return. Properties below a certain price will lose money – but a tax credit would help, and might incentivize them to build more. The proposal says there’ll also be a 20 billion dollar fund for housing expansion that is supposed to help with the construction of affordable multifamily rental units, that will create hundreds of thousands of units that will help lower rents.

Coming to rents, the last initiative in the proposal will help drive down monthly costs in two ways:

- Corporate landlords use algorithms to determine the highest rent they can generate and this could lead to “price-fixing”. The new proposal aims to clamp down on this. (I did a complete breakdown of how algorithms could be leading to price-fixing and what this means for landlords. Check it out here)

- They’re going to eliminate “junk fees” like convenience fees to pay rent online, fees to sort mail or collect trash, etc. that can cost more than the service they provide.

I agree that these fees could be getting out of hand, but I also see the landlord’s perspective that if they provide a service, they deserve to add a profit margin on it like any business – usually, this is just baked into the lease and rarely do I see it itemized. Topic for another day.

What can actually be done

As someone who’s actively worked in real estate for almost two decades now, I can’t help thinking that this is a misguided effort paved with good intentions, that practically won’t do much other than help people who were already going to buy or sell. It isn’t a one-to-one comparison, but the last time the government intervened in housing – by letting major lending institutions issue riskier subprime loans, to meet “affordable housing guidelines” – it didn’t end well.

If you want practical things that will actually make a difference to the housing market, these are my ideas (and I hope someone listens):

- Make it possible to take the mortgage balance and interest rate with you to the next home. If this happens, nearly every seller will relocate to a home that better suits their needs, and the only reason this isn’t a thing is because this would ruin the resale market for investors, to buy loans.

- Allow you to take the tax basis with you. Property tax values are generally tied to the value of the home at purchase – if you pick up and move to a more expensive home, you might end up paying a lot more. Allowing people to carry over their property tax basis (on their primary residence) would let them move without friction.

- Reduce capital gains on property sales. This is an unpopular one, but it’s true. Homeowners are sitting on record gains on properties they’ve owned for decades, and don’t want to sell because they could lose 37% of profits to taxes. Imagine paying $880,000 on a home that’s worth $3 million in California – if you had bought it for $100,000 in 1970, that feels like a terrible loss.

- Give tax credits to builders. If you eliminate or reduce taxes on profits generated from property development, so many developers will eagerly want to build anything they can. Even a subsidized interest rate would help construct more units. Ultimately it comes down to their margins – if there’s an incentive to build lower-priced units without as much risk, they will do it.

As a real estate guy, these four items would immediately create a measurable difference. Even I would consider selling if I could take my loan with me – and that’s saying a lot because I love where I live – but with the 2.8% mortgage on my home for the next 30 years, I’m not going anywhere unless I can roll it into another home.

The same applies to a developer – right now, interest rates are too high and there’s too much uncertainty to take the plunge. But if I knew that my profits were tax-free, that would change my risk profile. If the alternative to this is no new construction, it seems like a net benefit to me.

If you read till here, you might as well like and share it on LinkedIn and comment "Read till the end". I'll say hi :)

Hope you enjoyed reading this! Share it with a friend if you found it useful, and I’ll see you on the weekend with interesting money ideas that’ll make you a smarter investor.

113 Cherry St #92768, Seattle, WA 98104-2205

Unsubscribe · Preferences