Welcome to Graham's Newsletter! If this is your first time here, you can check out all previous issues here.

Why did a book about flies cost 24 million dollars?

In 2011, a postdoc researcher logged into Amazon.com looking to buy a copy of “The Making of a Fly.” Though the book was out of print, the researcher thought the book was a tad overpriced. Amazon had listed 17 copies for sale: 15 used from $35.54, and 2 new ones: one for $1.73 million, the other for $2.19 million (plus $3.99 in shipping). Both the sellers were reputed sellers, so the researcher didn’t understand what was going on and informed his professor.

When they logged in the next day, the prices of both books had gone up to $2.8 million! And they kept rising every single day. Turns out, the two booksellers were using an algorithm to set the price of the book – and they were using each other’s prices as the benchmark to keep raising the price of the book slightly. Somebody had forgotten to tell the algorithms when to stop while programming them, and the book eventually hit a price of $24 Million on Amazon!

Eventually, someone found this glitch and corrected the price manually. This is an amusing story, but it highlights two important things:

- Huge companies are using software to set prices and make big decisions.

- These algorithms sometimes lose all touch with reality and can lead to absurd situations.

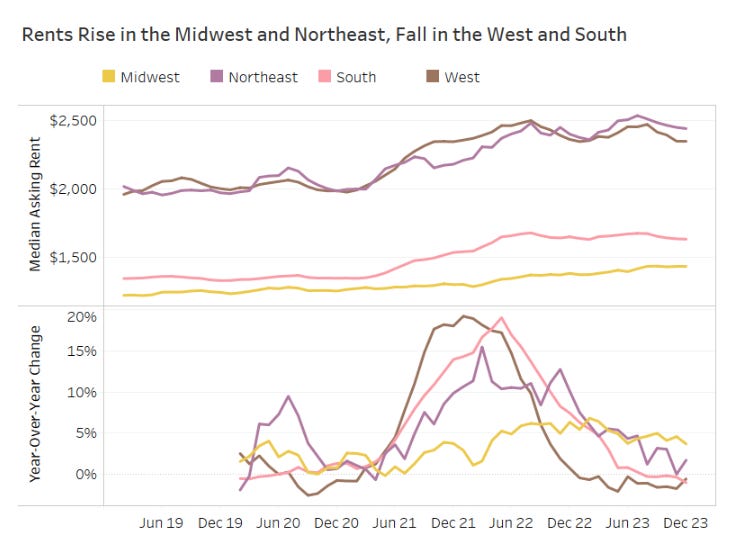

What about when something like this happens with the housing market? A recent documentary by BBC alleges that other companies are colluding with algorithms leading to a crisis in housing rental prices. US rents are at record-highs, with the average rent over all forms of housing coming in at $1,964 per month. Rents in the Midwest and Northeastern parts of America are skyrocketing – with rents in New Jersey shooting higher than $6,700 for some tenants. Some tenants are seeing a 23% increase in their rents, which they claim is “nothing short of serving an eviction notice.”

The root cause of the crisis is obvious – housing supply is blatantly inadequate, with a shortage of more than 4 million houses in the United States. But tenants and the Attorney General’s office in Washington are bringing a lawsuit against 14 landlords and a company called RealPage over what they allege is a housing cartel on over 50,000 houses. They’re alleging that these companies are controlling rental prices through an agreement with RealPage’s price recommendation software, making housing unaffordable for tenants. As a landlord myself, this case interests me:

- How is a computer program creating a “cartel”?

- Will landlords owe tenants money?

- What does it mean for the future of housing in the United States?

Let’s find out.

RealPage behind the scenes

Landlords used to set prices by comparing what similar houses are going for in the area, asking advice from more experienced folks, and taking the advice of analysts. Algorithms changed that. Jeffrey Roper invented a software called YieldStar that looks at over 20+ years of data and billions of data points to suggest the optimal rental prices, and when houses should be left vacant. YieldStar was acquired by RealPage in 2002 and combined with Lease Rent Options, another software, to create the AIRM tool (AI Revenue Management) software of RealPage.

While these suggestions are optional, around 90% of the time, users go with the software’s recommendations. But that alone doesn’t mean that there’s price-fixing going on. Everyone uses some form of analytics software to improve their business – so why is RealPage under fire?

The issue is that RealPage allegedly has high market concentration in the area. According to the complaint made by the Attorney General’s office for the District of Columbia:

RealPage’s public statements and internal documents organize properties into geographic “Submarkets” within the greater Washington-Arlington-Alexandria MSA, and the share of multifamily units using RealPage’s RM Software in some MSA neighborhoods reaches around 90%.

Portfolio companies that manage thousands of properties across the same area are using RealPage. Though they might not be communicating with each other, their use of RealPage is tricky. Like in the case with the book about flies on Amazon, one market leader might be setting a high price, and everyone else on the platform might be encouraged to set similar prices.

As one tenant in the CNBC documentary says, “the software takes empathy out of the equation.” Though that’s hard to digest, businesses generally optimize for the bottomline and the collateral damage is that this is passed on to the customers. But why is the software recommending high prices in the first place? Is it pure greed or something else?

A problem of supply

While the software is updating prices and resetting them at a much faster pace, the root cause of this issue is just supply and demand. If people are moving to a specific location and there’s a lot of demand, landlords will just raise prices because overhead costs like insurance rates are soaring in places like Texas, Florida, and California. That cost gets passed on to the tenants because landlords have to bear those costs.

The problem is that enough units aren’t being built. A lot of people (including me) are getting into real estate now, because they know that it could be way easier to build and develop units now than say, ten years from now. Building materials, insurance, labor costs, liability insurance are all getting more expensive. In order to break even, anyone who’s building now is taking on risk – and to recover those costs, they charge higher rents that are passed on to tenants. If there’s no incentive to take risk, people aren’t going to build more houses, which will worsen the problem by keeping the supply low and pushing rents even higher as demand increases.

Luis Quintero, Assistant Professor at John Hopkins Carey Business School said that as prices have gone up since 2011, new developers have not entered the market sufficiently enough to combat the price increases caused by incumbents.

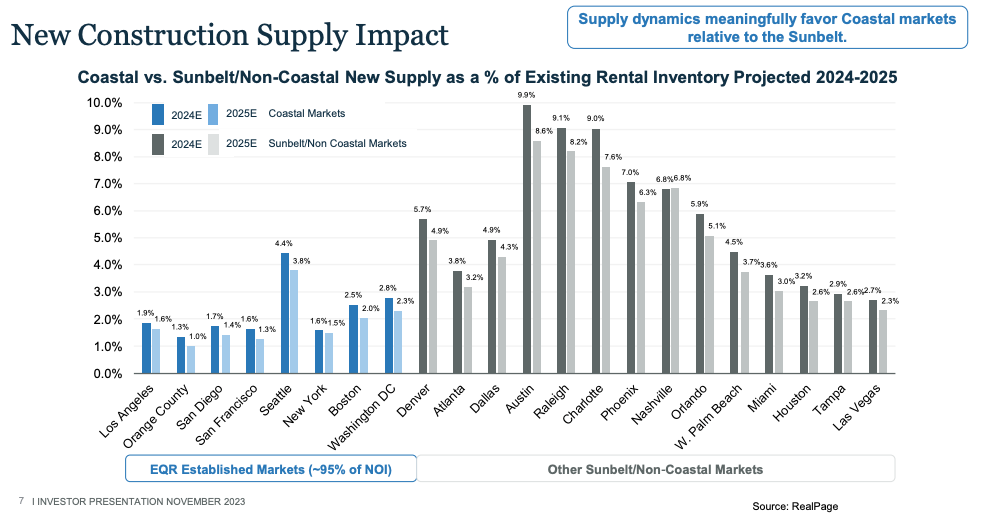

New construction in Key Housing markets like Orange Country, San Francisco, and New York is low, according to forecasts shared by companies like Equity Residential. As the CEO of Equity Residential says, they're 96% occupied, and raised their dividends by 6% a few months ago – because housing is undersupplied and expensive, giving landlords more power to raise pricing.

So how is the law responding to this?

The lawsuits

First, there’s the lawsuit by the Washington DC Attorney General on over 50,000 houses. The claim is that they charged inflated rents for years using RealPage’s price recommendations, and tenants are seeking reparations that could amount to millions of dollars. The question is: Does the conduct of RealPage and the defendant landlords meet the legal definition of collusion? The Attorney General says that they are seeking three things:

- To put an end to anti-competitive practices

- To bring in a monitor to keep a close eye on how software sets prices

- To provide restitution and compensation for tenants who were subject to inflated prices that would otherwise not have been set by a fair market

The third point is very tricky: How do you decide in hindsight what the fair market price for a naturally competitive market would have been? As far as I’m aware, there’s nothing to stop software from being used in a competitive market, at least here in the US. Europe took the lead in 2017 to study whether automated pricing by algorithms can lead to price collusion, but we don’t have any such systems in place yet.

The people who built the software, like Roper, claim that there isn't enough market concentration to bring in pricing dominance, and the software was built with specific failsafes to prevent collusion. Of the four defendants in the RealPage case, three filed motions to dismiss in January, but an initial conference for the case is now set in May 2024. Private Equity Giant Thoma Bravo acquired Realpage in a $10.2 Billion Deal in 2020. Now they claim that Thoma Bravo isn't liable for the acts of its subsidiaries.

The case brought by the Attorney General says that the terms that the landlords and property managers agree compel them to charge the prices that the algorithm recommends, instead of making independent decisions based on market circumstances (over 90% of clients comply with RealPage’s suggestions). RealPage says that there is no obligation for the clients to go by their price suggestions. According to me, it doesn't sound like the clients are compelled. But if a user is paying a flat fee and expecting a profit over other landlords for using RealPage, then they’re likely to follow the recommendations to get their Return-On-Investment.

In 2023, the Department of Justice filed a case alleging that use of the software violates the Sherman Antitrust Act. There's a February 2024 deadline to respond.

This case is huge: It’s not just about real estate, but it’s going to set a precedent for the role automated software plays in setting prices and optimizing business, from retail groceries, to hotels, to travel, to literally everything because no company is completely manual in its operations these days.

According to me, the problem with rental prices shooting up so high is because the housing market is suffering from a supply shortage, and my rough guess is that if we double the number of houses that are being built, rents could fall by as much as 30%. For that to happen, regulations need to change to encourage people to take the risk and build more. On a broader scale though, this is probably a sign of things to come – as algorithms get better and are involved in decisions with more leverage, lawmakers will start taking a serious interest in how these programs are affecting end customers.

What do you think? How can we encourage innovation in technology while also protecting the interests of customers?

Let me know by replying to this email – I read every single reply.

Stay safe, stay invested and I will see you next week – Graham Stephan.

113 Cherry St #92768, Seattle, WA 98104-2205

Unsubscribe · Preferences