What’s up Graham, it’s guys here :-)

Now that my schedule is slightly more flexible, if you’re interested in booking a consulting call and speaking with me directly, fill out the form below to see if it’s a good fit.

I’ll make some time each week to speak with a few of you, one-on-one, about your YouTube channel, Real Estate Deal, Business, or Marketing Strategy (no investment advice). If you’re interested, reach out and I’ll pick a few people to consult with. It can be over a phone call or Zoom (your choice). Thanks for reading!

Back in the early 1900s, horses reigned supreme as the primary mode of personal transportation. If you were a common man, you would most likely rely on a trusty horse to get around, while only the rich & elite could afford the luxury of owning a motor car. It was impossible to imagine back then that the roles would be completely reversed in the future.

This all began to change in 1908 when Henry Ford revolutionized the automobile industry by introducing the Model T Ford. His vision was simple yet profound — to create a car that was affordable for the masses, not just a luxury for the rich.

The idea seemed like a pipe dream. Cars were a symbol of wealth; they were hand-built and expensive to produce. But Ford didn’t just dream — he acted. And today, Ford’s dream is a reality. Cars dominate the roads, and the days of horses as a primary mode of transport are long behind us. What was once a symbol of wealth is now common in daily life and affordable to almost everyone.

Or is it?

Fast-forward to 2024, we are witnessing an epidemic in America — car ownership has spiraled out of control and is now the number one wealth killer for the average middle-class person. It’s unbelievable that more and more people are purchasing unaffordable cars, driving up the average price of a new vehicle to around $50,000! Apart from this, the prices of used vehicles have also increased at a staggering rate for the last two years.

So, let's examine why car ownership has become so expensive and what you can do to avoid the financial pitfalls.

Why Car Ownership is Out of Control

Just like a house, a car is one of the biggest purchases a person will make in their lifetime, but unlike a house, a car starts losing value immediately after you drive it off the lot. Recent years have distorted people’s perceptions; suddenly, buying a used car at above asking price, driving it for a year, and selling it for more than what you paid became the norm. This doesn’t make any sense in the long run.

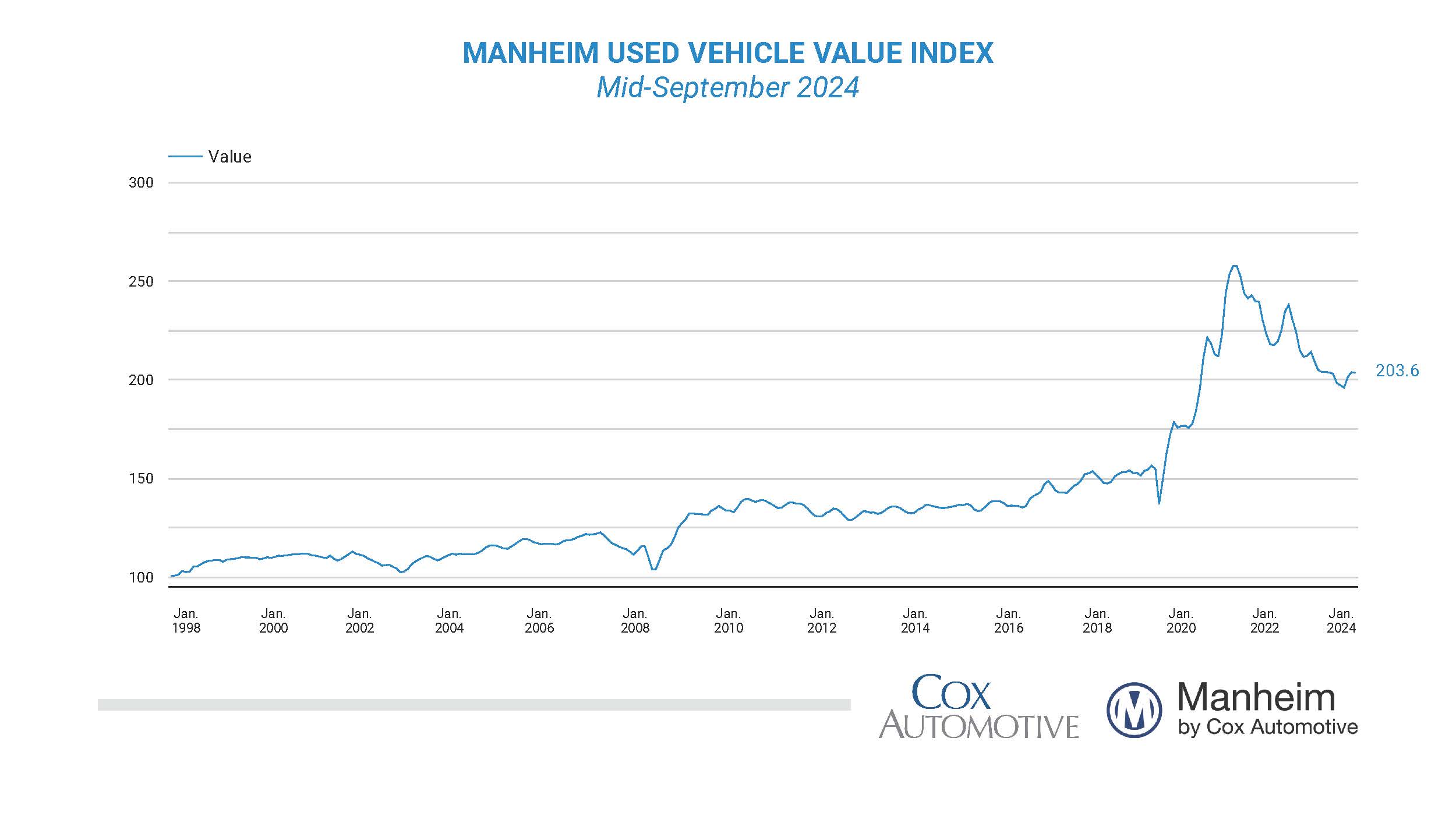

However, this situation was an anomaly. Now, as the market begins to stabilize, car values are returning to their natural state — depreciating assets that lose value the moment you drive them off the lot. But people seem to forget that just five years ago, it was absurd to think that a car would ever increase in value after purchase.

The Surge in Used Car Prices

The used car market is massive, with around $40 million in sales each year — more than double the sales of new cars. But something strange happened in 2020. The pandemic turned the car market upside down, making used cars more expensive than ever.

This is because, during the pandemic, a shortage of chips and other manufacturing delays caused a drastic reduction in new car production. This, in turn, led to an increased demand for both new and used cars, driving prices through the roof. People started keeping their vehicles longer, and with fewer cars available, prices soared.

But those scenarios were exceptions rather than the norm. Usually, buying a used car that is about 5 to 7 years old and reliable with medium mileage is your best bet to minimize financial losses. You drive it until the wheels fall off — that’s how you maximize value.

Before the pandemic, I would look at cars that had taken their initial depreciation hit and had reached a point where they would hold their value reasonably well. Like a seven-year-old Toyota Prius, these cars would likely retain their value over the next few years, even with additional miles. Certain vehicles, like a used Mercedes G-Wagon or a Lotus Elise, could even be driven for a few years and sold for nearly the same price you paid.

With fewer cars being available in the post-pandemic world, prices for both new and used vehicles shot up. While prices are now gradually decreasing, the market still remains skewed. If you have a car now, it might be worth holding onto it for a while as prices continue to settle. But while you’re holding on to the car, you also need to consider other costs such as maintenance, repairs and, more importantly, depreciation.

Depreciation

Cars typically lose about 10% of their value the moment you drive them off the lot. This depreciation happens because the market prices are based on the probability that you received a discount or incentive on the vehicle, even if you didn’t. In my opinion, a new car should be seen as new for the first few thousand miles, but the moment it’s driven off the lot, it’s considered used and loses value. This makes it clear that purchasing a new car comes with an accelerated depreciation of sorts -- an unavoidable consequence of ownership.

However, not all car owners get to keep their vehicles for long. People have various reasons for selling slightly used cars — moving, divorce, life changes — but in today’s market, I would assume people can’t make the payment because they purchased a vehicle they can’t afford.

The Financial Trap of Auto Loans

More than 100 million Americans have an auto loan, contributing to a staggering $1.5 trillion in auto loan debt in the US. The problem is exacerbated by the availability of long-term loans, some extending up to 144 months! These loans often come with high interest rates, making them a terrible financial decision for most people.

Auto loan companies are also largely unregulated, allowing them to issue loans freely. They sometimes finance up to 120% of the car’s value, leaving many people underwater on their car loans and struggling to keep up with payments. Worse, until you fully repay the loan, the lender holds the title and can repossess the car if you fall behind on payments. This is why selling the car yourself is critical if you’re at risk of repossession — you can pay off the loan, pocket the difference, and avoid a hit to your credit. You can also avoid this entirely by purchasing a car you can afford rather than the car you want, because it's probably more expensive than you think.

How to Purchase a Car Wisely

To avoid falling into the trap of expensive car ownership, it’s important to do your research before making a purchase. Here’s what I would do:

- Shop around for the best loan rates. Go to at least three different banks and negotiate.

- Know your budget beforehand, and stick to it. This can save you thousands of dollars in the long run.

- Avoid Buy Here Pay Here dealerships, which often charge exorbitant interest rates, sometimes as high as 20%.

For those looking to buy a car now, it might be wise to wait. Prices are coming down, and you’ll likely find better deals if you’re patient. If you already own a car, consider holding onto it a little longer until you find a good deal.

That's it for this week. I hope you enjoyed this article. Let me know your thoughts by responding to this email - I read every single comment :)

Stay safe, stay invested and I will see you next week – Graham Stephan.

113 Cherry St #92768, Seattle, WA 98104-2205

Unsubscribe · Preferences