Here’s a thought experiment: An AI program tells you that a market crash of 30% will happen within the next five years, and you can prepare for it. What would you do? Would you hold cash waiting for the crash to happen? Would you be excited for the crash? Would you avoid investing altogether and "play it safe"?

Now hold that thought while I add one more detail – The AI program is faulty. While the market crash is definitely happening, it could happen in 8 years or 3 years instead of 5 years. It could last for a year or it could last for a couple of weeks. And the program tells you nothing about how the rest of the world looks when the crash happens:

- Is there an economic crisis going on that threatens your income?

- Is there a war?

- Is inflation threatening all your savings?

- Has the reserve currency of the world changed?

The AI program tells you none of that. How would your plan change then? Now here’s the kicker: You don’t even need an AI program to tell you this. Market crashes are inevitable, and they do happen with regular frequency. But long-term investors are sometimes caught unprepared because as Morgan Housel said,

Saying “I’ll be greedy when others are fearful” is easier than actually doing it, because people underestimate the odds of themselves becoming one of the “others.”

I sometimes get criticized for warning about market crashes too frequently. However history shows that bear markets and market corrections are as much a part of the market as bull markets and market rallies. By being caught unprepared, you might miss the best opportunities, like this investor who violated his 40 years of investing discipline during the pandemic.

Why is this important to talk about now? The metric used to check if the market is overvalued, the Shiller PE ratio, is in the top 1% of its historical range – and we might be heading for another market correction. I can’t say when it’ll happen, but by understanding the past and following these guidelines, you’ll be in a better position in the future:

How frequent are market crashes?

To answer that, it really depends on how much it drops. Based on the severity, I like to classify market crashes into three types:

- Corrections

- Bear markets

- Collapse

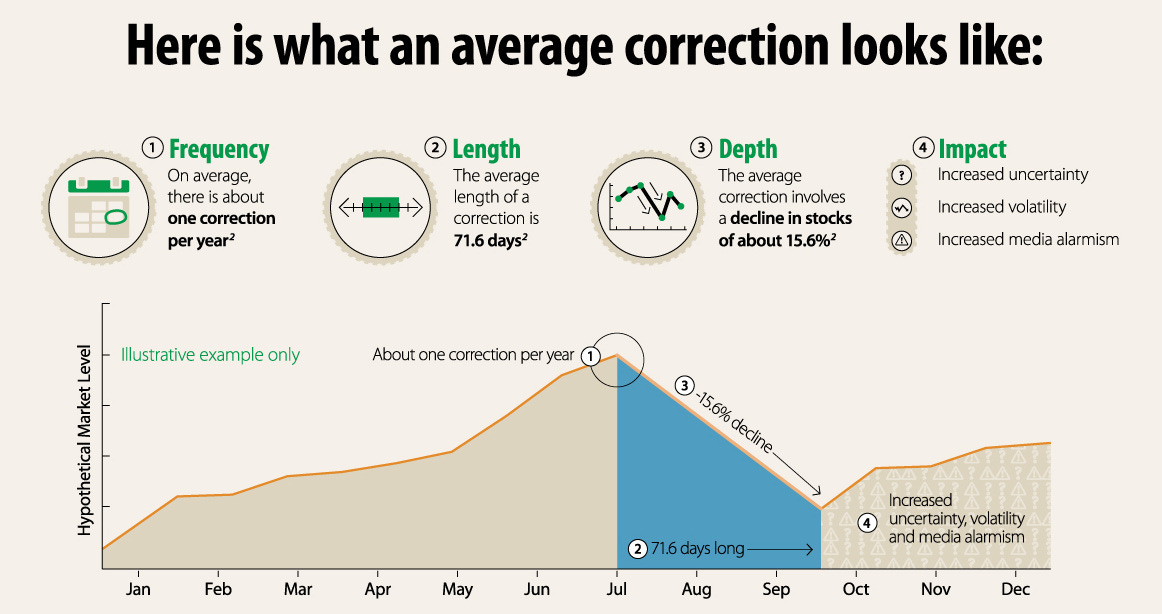

A stock market correction is when the price drops by at least 10%. Normal volatility in the market is pretty common. 10% corrections are fairly common. The market drops by 15.6% on average, once every 16 months, and this correction lasts for 71.6 days.

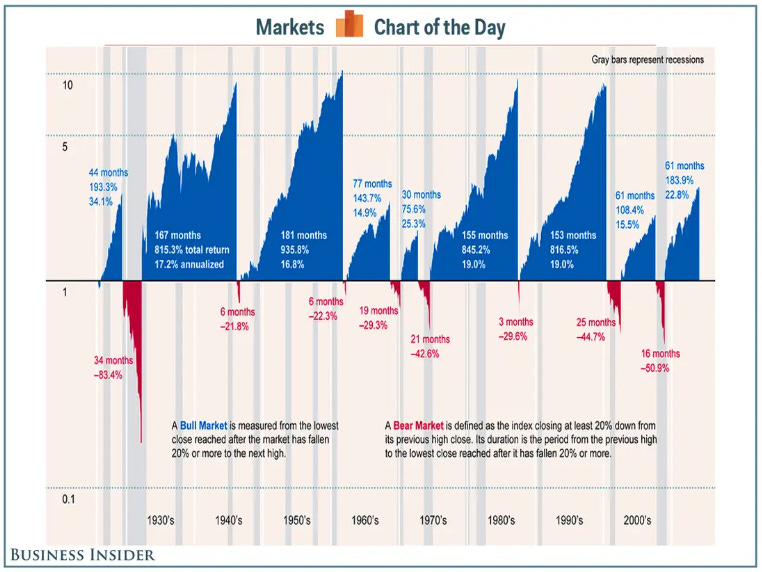

Bear Markets are more serious – They are defined as a drop of at least 20%, and they are much less common. They typically occur once every 7 to 10 years, and when they do, they hit hard. The market drops by an average of 33%, and this can last an average of 363 days! And that’s on average – In March 2020, we saw the fastest 30% drop in history since the Great Depression, so anything can happen.

Stock market collapses are the scariest, defined as a drop of over 40% throughout the entire market. The insidious danger with collapses is that though they have occurred only three times in the last 120 years, but their memory can be so heavy that every bear market can feel like an impending collapse, causing people to panic and derail their investment plans. An actual collapse is rather uncommon, but not impossible to happen at some point throughout our lifetime.

Once we understand the differences between these, and how often they happen, we can begin to come up with the best way to take advantage of them and make them profitable.

Why could a crash be around the corner?

Historically speaking, stocks are very expensive right now. I’ve heard quite a few arguments in favor of this, but one argument by economist John Hussman stands out. He points out that stocks are trading at levels that haven’t been seen since 1929 and 2001. Because of that, he believes that “These levels indicate the S&P 500 is likely to return around -5% annualized over the next 12 years”.

According to him, bubbles happen primarily for two reasons:

- If enough speculators believe that prices rise when a squirrel-monkey tap-dances – and then a squirrel-monkey starts to tap-dance – then prices go up at least in the short term. i.e stock prices rise but not because of fundamentals.

- But in the long term, future cash flow is what determines value. Higher valuations still mean lower long term returns, which is why no speculative episode ends well.

Basically, investor psychology plays a large role in how the stock market trades, and when the gap between reality and speculation widens, bad things tend to happen. Instead of going by hearsay, Hussman developed his own measure of how risk-averse investors are, what he calls “the market internals”. Since 2000, any time that the market internals have been “flat” for a long time, a market crash has occurred. He says that the signals are now pointing to a stronger likelihood of another stock market decline.

To give some credit to these claims, John Hussman correctly predicted that tech stocks would crash 83% in 2001, before they literally fell 83%, and he also predicted the “lost decade of stocks” in 2000, and the 2008 Great Recession, right before everything collapsed.

Hussman's own market performance since then has been pretty… terrible. His strategic growth fund (HSGFX) is down 40% since 2000, his Total return fund (HSAFX) is up only 11% in the last 5 years, and his strategic allocation fund (HSAFX) lost 4.5% over the last 5 years. Hey, even a broken clock is right twice in a day, so is he really right about a coming crash?

But he isn’t alone in his thinking – economist David Rosenberg compares the stock market to an expanding balloon ready to pop, and his explanation is simple: Corporate profits in the last year haven’t kept pace with the S&P 500’s growth, meaning that the majority of gains aren’t attributable to improvements in earnings results and the market is going higher for three main reasons:

- A better-than-feared economy

- Significant jumps in earnings estimates

- The expectations of lower rates

His “bear case” is an S&P 500 returning to a price of 3,200 or a 39% drop from today’s levels, unless companies can dramatically expand earnings over the next 6 to 12 months. Legendary investor Jeremy Grantham also seconds this by noting that prolonged bull markets typically begin when unemployment is high, profit margins are depressed, and stock valuations are beaten down – precisely the opposite of where we are now, especially when the Shiller PE ratio is within the top 1% of its historical range.

Planning for the crash

I’m not suggesting a market drop is imminent. There are as many arguments for a “bull case” as there are for a “bear case”. But if history is any indicator, a crash is coming at some point, and the approach to deal with it isn’t to predict its timing but to develop a resilient plan that is flexible enough to handle any surprise.

So with that in mind, here are my suggestions:

1. Always keep a 3-6 month emergency fund at all times: The biggest spanner-in-the-works in investing long-term isn’t greed, it’s just survival. You might wish to stay invested for 15 years and invest only the money you think you “don’t need”, but unless you have 3-6 months’ worth of your expenses saved up in cash, the slightest disturbance – like an unexpected pay-cut or job loss – can twist your hand. An emergency fund gives immunity to your investments.

2. Diversify your investments: If 90% of your wealth is invested in Nvidia, Reddit, and Truth Social, there’s a solid chance you can lose a big chunk of money. If you aren’t properly invested across different companies in different sectors, you risk one swing wiping out your portfolio. That’s why I have a small piece of ownership in everything, from index funds, real estate, to treasuries and bitcoin. Even if the entire market falls, I have cash on the sidelines to keep buying in.

3. Keep buying in: It’s gut-wrenching to see your investments drop 10% in value and keep dropping the more you buy in. But study after study shows that the best thing you can do is to stick to your plan, keep buying, and hold. A bear market might lose you an average of 33% – but unless you lock in that loss, a bull market can net you an average gain of 158%, and they last 5 times longer.

4. Don’t panic sell: The psychology that pushes you to sell because your investment is dropping is the same one that causes you to buy in at all-time highs because you don’t want to miss out. In fact, throughout the 1980s, Peter Lynch’s fund earned a 29% annualized return, but the majority of his investors made only 7% per year – underperforming even the market – because they panic-sold and hype-bought.

5. Keep extra cash on the sidelines: This isn’t the optimal advice to maximize your returns, but for me it’s the optimal way to maximize my peace of mind. Having some cash on the sidelines lets me invest in unexpected opportunities or deal with crises, and it helps me sleep a little easier at night.

Investing in the stock market is a long-term activity. If you need this money in 3 to 5 years, it’s not a good idea to invest in stocks. Ideally, you should view your stocks as a 20-year investment, because in the entire history of the stock market, a 20-year holding period has never produced a negative result even once. That literally means you could buy in at the absolute top, the day before a catastrophic crash - and then, not make a single investment for another 20 years - and still make money over that timeframe, based on past performance.

As long as you plan long term, start early, and invest consistently, you put yourself in the best position to come out ahead, regardless of the market conditions.

If you liked that article, why not share this post and follow me on Linkedin? I post short posts there that don't fit into the articles.

That's it for today. I hope you enjoyed this article. Let me know your thoughts by responding to this email - I read every single comment :)

Stay safe, stay invested and I will see you next week – Graham Stephan.

113 Cherry St #92768, Seattle, WA 98104-2205

Unsubscribe · Preferences