A 33 year old real estate agent and investor with over $120M in residential real estate sales. This is my way of sharing actionable ideas that will make you a smarter and wealthier investor.

How to pay no taxes in 2024

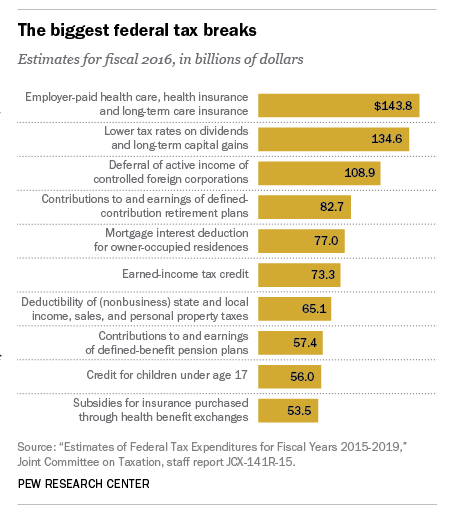

The average single worker in the US paid 30.5% of their income to taxes – that means that one third of your entire working year is spent just earning enough to pay the IRS. If that trend continues, you’re going to spend a third of your life on taxes, and even though you stop “earning” when you retire, you’ll still have to pay taxes. But it doesn’t need to be this way. Most people have access to a number of ways to reduce their tax bill by a lot – and I’m talking about perfectly legal ways that nobody talks about. The IRS isn’t advertising these options either, because they’d make less money if you started using these strategies. So today, let’s understand how exactly the tax system works, the best ways you can immediately start saving money on your taxes – legally – and apply this to every area starting from your salary income and retirement savings to stocks and real estate gains. It doesn’t matter whether you’re making $10,000 or $10 Million – these strategies are going to work for everyone. Quick winsFor most people, there are two strategies that can save a lot in tax money right away. The first secret is to make your income look as low as possible without actually reducing your income – and I’m not talking about taking out loans against arbitrarily valued assets. The easiest way to do this is by contributing to a traditional 401k. A 401k is a tax-advantaged retirement account that lets you contribute up to $23,000 of pre-tax money, reducing your taxable income by that amount. For example, if you make $65,000 a year and you contribute $15,000 to a 401k, you’ll be taxed as if you earned $50,000. In a 22% tax bracket, that’s an immediate saving of $3,300. But when you retire, typically at the age of 59.5, you’ll eventually have to pay taxes, and your tax bracket might be higher in the future than it is now. So the 401k makes sense in two scenarios according to me:

For most people though, the 401k is a fantastic way to save on taxes while also growing the value of their assets. The second strategy is to use a Health Savings Account or HSA. A HSA is used to specifically pay for out-of-pocket medical expenses, but with the added benefit that you can even invest within the account and potentially grow your tax savings further. This is one of the best tax savings accounts in existence for two reasons:

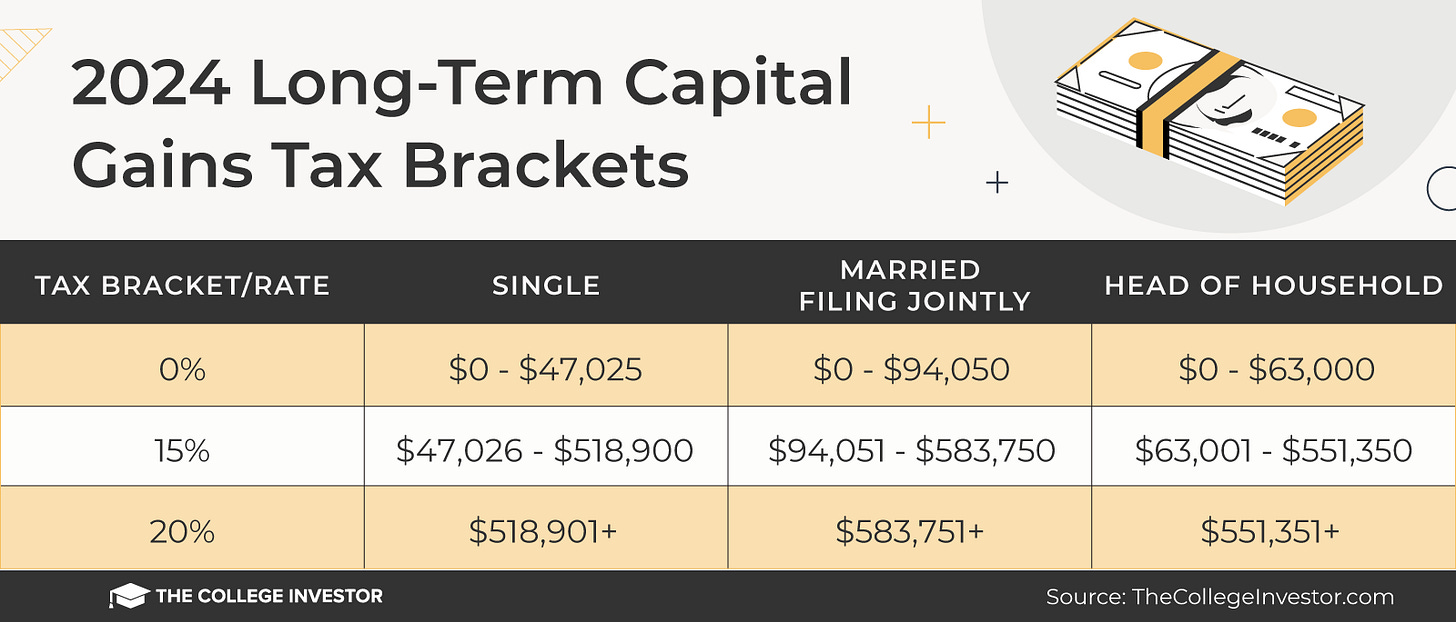

Now, considering that we all have health-related expenses at one time or the other, the HSA is a no-brainer for me. It’s like getting tax-free money to invest, and in a 22% tax-bracket, that’s a net savings of $1,000 for maybe around 10 minutes of work. The catch is that you must qualify for it by having a “high-deductible health plan”. In 2024, that means having a deductible of $1,600 for individuals, and $3,200 for families (and some fine print depending on your state), but if you fit the criteria, this is one of the best ways to save money, hands down. Next, let’s look at one strategy that you can use to make the most of your gains in the stock market. Long term capital gainsIf you buy an investment and sell it for a profit within 12 months, that profit is considered ordinary income, and it’s taxed as normal income. Depending on where you live, that could be as high as 37% plus State Income Taxes. However, if you hold that investment for longer than one year and then sell it for a profit, it’s taxed as long-term capital gains. These are taxed at a much lower rate.

If you make $47,000 to $518,000 a year, the federal long-term capital gains tax is only 15%. That could lead to massive savings for anyone who makes more than $50,000 a year. Even better, if you make less than $94,000 a year as a married couple filing jointly, you owe nothing on your long-term capital gains. You could make up to $94,000 a year and owe $0 to the IRS. On top of this, qualified dividends also get the same lower tax treatment when you hold a stock for more than 60 days on approved US-based and foreign companies. So the next time you’re about to invest in short-term call options based on a hot tip from WallStreetBets, remember that what you retain in hand is much lesser in reality. This is why I personally love the buy-and-hold strategy of market-based index funds. The returns tend to be safer and higher over the long term and on top of that, the taxes I pay are way lesser. Money saved is money earned.

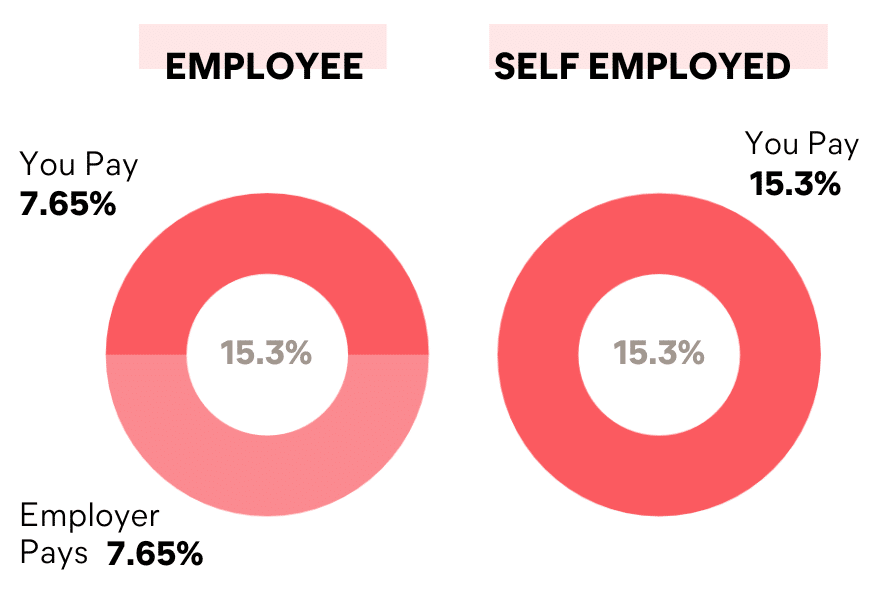

Now, after this comes the option that is most applicable to me and my favorite option to save money for anyone who’s running their own business to save a ton of money. This is a bit nuanced, but it’s worth the effort to learn about this: Setting up an S-corpAs someone who’s self-employed, one of my favorite ways to reduce my tax bill is to set up an S-corporation or an LLC taxed as an S-corp. An S-corp is nothing but a legal entity that you run your business through. Your business income is received by the S-corp, expenses for the business come out, and then you take what’s left over personally as a distribution. Your S-Corp becomes your “employer” and you become the “employee”. As an employee of that business, you are paid a “reasonable base salary” after which you’re entitled to all the profit. Now why does this make sense for self-employed folks? Because, distributions made by an S-Corp aren’t subject to social security or medicare taxes – this can save you up to 15.3% on your money. For example, if your business earns $120,000 per year in profit and your salary is $60,000, you’re saving $9,180 in taxes on the remaining $60,000 distribution just because you run it through an S-Corp!

Now, this is something you need to discuss with a CPA because it’ll depend a lot on your specific situation. There are requirements that you must follow and be 100% compliant with. But now that you’ve heard of the idea here, you can do your own research and be on your way to save 15.3% of your income. On that note, there’s one more thing: Salt Cap WorkaroundFor certain states like California, New York, New Jersey, or anywhere with a high state income tax, there’s something called a SALT Cap Workaround. In 2017, the Tax Cuts and Jobs Act limited your deductions on State and Local Taxes – till then, you could deduct your state income tax and property tax against the amount you owed the IRS – and many people wound up paying a lot more in taxes. But that changed recently. Some states have issued guidance on a “SALT Cap Workaround”. This lets you deduct your state taxes in their entirety, saving you a ton of money. How it works is like this – instead of the S-Corp owner paying themselves the full distribution and paying taxes to the state on a personal level, the S-Corp will first pay its portion of state taxes. This deduction will transfer to you as credit on the individual level, allowing you to use it as a tax write-off. 30 states have already approved this strategy, and even the IRS has issued their guidance on how to proceed with it. Of course, check with a professional before you do decide to proceed with it, because I’m just telling you about the possibilities. DON’T proceed with major decisions based solely on what I (or anybody else) writes or talks about online. Strategies for homeownersIf you’re a homeowner, there’s a bunch of huge tax breaks that you’re eligible for that you might not be even aware of. Here are some of my favorites: 1. The Capital Gains Exclusion If you’ve lived in your home for at least 2 out of the last 5 years, this rule allows you to sell your primary residence and pay no tax on up to $250,000 worth of profit if you’re single, or $500,000 worth of profit if you’re married. For example, if you bought a $500,000 home in 2018 and it’s now worth $1 Million, you’d get $500,000 in long term capital gains for selling it. Ordinarily, you’d have to pay $100,000 (20%) in Federal Income Tax for selling it, but with this rule, you pay nothing. Sadly, this only applies at the Federal and not the state level, but $100k in savings is still a big bonus! 2. The 1031 exchange If you own a rental property, this rule lets you defer paying taxes when you sell a property, indefinitely, as long as you “exchange” it for another one within a certain time. Let’s say you sell your $100,000 rental property for $300,000 – if you reinvest the $300,000 into another investment property, you can “roll” your profits into the new investment without having to pay tax on the profits! Some real estate investors defer their taxes indefinitely and keep trading up to make more money at every stage. You can’t do this on a primary residence, but if you have a rental property, look into this. 3. Depreciation This strategy lets people make thousands of dollars in profit every month but claim they lost money on paper, and pay nothing in taxes. According to the IRS, your property has a lifespan of 27.5 years. As the home gets older, it loses value on paper because the property wears down and gets less valuable, and you’ll have to spend more on repairs and maintenance. If you have a structure worth $275,000, you can divide that value by 27.5 – which gives you $10,000 per year that’s seen as a loss. If you earn $10,000 worth of rent as profit, you could deduct $10,000 worth of “depreciation on paper” – and you rental income is tax free, all of a sudden. There’s also something called cost-segregation analysis, that lets you take a huge amount of depreciation upfront (without waiting 27.5 years for the full write-off), and after the complete write-off is taken advantage of – you can roll it over into a 1031 exchange to buy a bigger property and repeat the process. But this needs a very experienced CPA, tax attorney, or similarly qualified professional to execute, so keep that in mind. 4. Refinance With mortgage rates being high, refinances don’t make too much sense right now, but if and when rates decline and you want cash out of your property without selling it, this is a great option. The IRS doesn’t see loans against your assets as “income” because you didn’t technically sell – and so you don’t owe tax on it. So for example, if you have a home worth $100,000 that’s now worth $200,000, you could sell it and pay taxes on the $100,000 – or you could avoid taxes by borrowing against the home equity you have. There’s more to it than that, but you could explore this when the time’s right. 5. The Real Estate Professional Tax Break If you have a W2 income, you’re limited in terms of write-offs – but if your spouse is a real estate professional, it opens up the possibility for a nuanced tax break that not many people know of. All of your spouse’s “real estate paper losses” (through depreciation, cost-segregation, etc.) can be offset against your wages, allowing you to make a lot of money and owe nothing to the IRS. Of course, you can’t just claim to be a real estate professional – you have to back it up with the IRS by showing proof of “at least 750 hours per year in real estate” and “spending more time doing real estate activities than all other business activities combined.” But if you qualify, it’s a great strategy. And finally – hire a very good CPA, the best you can afford. While I can give you ideas and strategies that you might be able to implement, a CPA will understand your situation, the tax code in your location, and all the moving parts that are unique to you. This is an area where DIY might hurt more than it helps. I spend well into the five-figures every year on good tax advice myself. You might not need to spend anywhere close to that, but the expense is worth it. A good CPA hired early in the tax year can give you the best advice on how to structure your business and reduce your tax liability. That’s it for this week! If you have a tax strategy you’ve found helpful, let me know by replying to this email. I read every mail, and I’ll try my best to reply. Meanwhile, if you found this useful, please share it with one friend whom you think needs to see this. See you next week! 113 Cherry St #92768, Seattle, WA 98104-2205 |

Graham’s Newsletter

A 33 year old real estate agent and investor with over $120M in residential real estate sales. This is my way of sharing actionable ideas that will make you a smarter and wealthier investor.