A 33 year old real estate agent and investor with over $120M in residential real estate sales. This is my way of sharing actionable ideas that will make you a smarter and wealthier investor.

How to get a perfect 800 credit score

Money is expensive now. Mortgage rates are breaching 7% for the first time in two decades. Banks are getting increasingly cautious about who they lend money to. Whether you need money to start a new business, apply for a mortgage, buy a car, or just have access to money when you need it, there's one number that matters – your credit score. When you're at school, your report card dominates your life. But once you leave school, your credit score is the metric that people look to. Over the last 13 years of my investing journey, I have obsessively studied every aspect of building credit. Improving your credit score can change your life. I wanted to put together a guide for anyone to get to the "perfect score" of 800. Well, now I have an 800 score, and the benefits are incredible – I get the best rates, and banks don't think twice about lending me money. I'm also approved instantaneously for any credit card that I want. In this article, I'll teach you exactly how to get that perfect credit score from scratch, in much less time than it took me. How do Credit Scores work?To get to a perfect credit score, we need to look at what goes into calculating your credit score. There are a number of factors, but some matter more than others: Payment History: Your payment history is the biggest contributing factor to your credit score. Always pay your bills on time, as agreed. If you end up missing a payment, it could stay on your report for up to 7 years. To avoid getting flagged, you just need to pay the minimum due amount (most of the time around ~$25-50), and not the full balance. Even if you can’t pay off your credit card in full, just make the minimum payment and your credit score will stay intact. We're all human and we tend to forget – so it's better to set up a monthly autopay for the minimum balance and forget about this. Amount Owed aka Utilization: What portion of your total available credit you use also tells banks whether they can lend money to you safely. Check out this example where two people are spending the same amount every month but with different credit limits: The dollar amount doesn't matter as much as the "utilization" – someone who maxes out their card on a shopping splurge will be considered a riskier borrower. Average age: No, it’s not your age that the credit algorithm is worried about. It’s how long you have had your credit accounts open and in good standing that matters. Banks are more comfortable giving loans to people with a longer credit history. Something to note – it’s the average age of credit history that’s considered and not the total age. So taking more credit cards drops the average age of your credit history, which isn't that great. Types of Credit: The number of different types of loans you take on – including Credit Cards, Auto Loans, Mortgages, etc. – proves to lenders that you're capable of handling a range of credit types. One added benefit of having multiple types of credit is that your overall utilization would be on the lower side which again positively affects your score. Credit Inquiries: Finally, the last 10% of your credit score is impacted by the number of times you apply for a new line of credit. This is shown as a ‘hard inquiry’ on your report. In general, the more hard inquiries you have, the lower your score will be. This is because lenders will be concerned that you are actively trying to seek multiple new loans and credit lines and you are seen as a potentially risky borrower. Personally, I am not so worried about the credit inquiries part as it only impacts the score temporarily (a few months at most). How to get and review your Credit Score“If you cannot measure it, you cannot improve it” - Lord Kelvin Before we go trying to improve our score, we have to first know what our current Credit Score is. There are multiple websites that can help you here.

Pro tip - If any website ever asks you to pay for your Credit Report, just click out of it. There is no need to pay for information that’s freely available. When you review the report, you can see which items can be improved, and usually, it’s going to be one of these. Don't worry, we'll figure out how to solve each one of these:

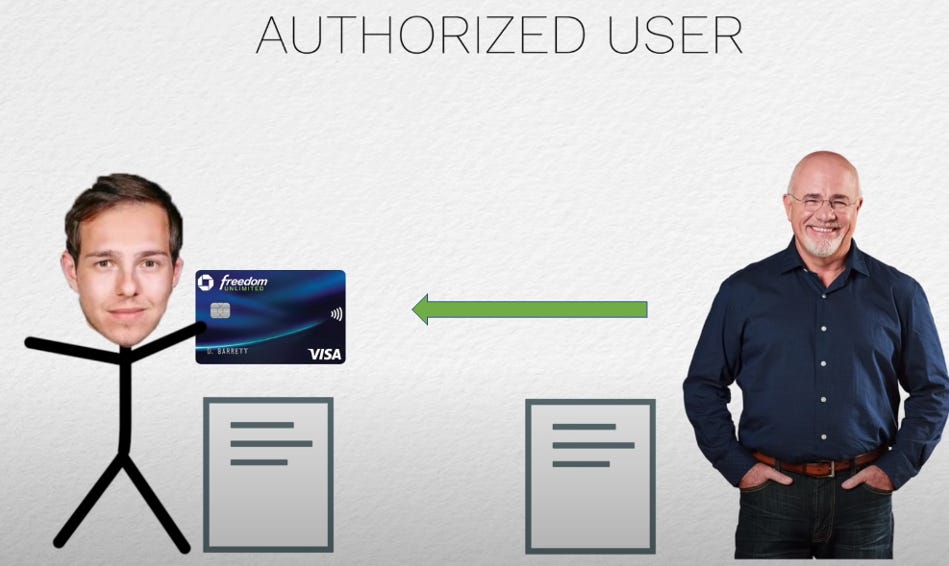

800 and beyond!Now that we know what goes into making up the credit score and what your current credit score is, we can explore the various ways in which we can improve them – for free! Authorized UserIf you don’t have enough credit, and you want to increase your score immediately, the best method is to become an ‘authorized user’.

This is when someone else with an extensive (and good) credit history adds you as an authorized user to their credit card. All of a sudden, their credit history shows up with your account. This is also known as “Credit Piggybacking” and is one of the fastest ways to improve your credit. However, there are some ‘catches’ here that you should be aware of.

Pay down your balancesAnother quick way to improve your credit is to pay off the existing balance so that your overall utilization comes down (Remember that Utilization contributes 30% to your score)! Ideally, you should try to keep your utilization under 10%. Paying down your credit card balance can improve your score in as little as If you can’t pay off your card, another ‘hack’ here is just getting a new credit card. As we discussed in the beginning, utilization is based on the total limit, and adding a new card will improve your total limit bringing down your utilization %. This is why I recommend opening up as many no annual-fee credit cards as you can so that the utilization is kept well below 10% (This might impact your average credit age, but utilization has a higher weightage in the credit score). Experian BoostAs we saw, when calculating the credit score, a large portion of that score is calculated based on the number of on-time payments, your account history, and the type of loan that you have used. Obviously, this requires you to open multiple credit lines, pay them all off on time, and keep the utilization low – all of this is pretty difficult to keep track of. Experian Boost aims to fix that and I feel most of you would qualify. This isn’t sponsored: But Experian Boost is a totally free, opt-in service that tracks on-time phone and utility payments and adds them as a parameter for calculating your credit score. if you make these payments on time, Experian Boost can help you boost up your credit score pretty fast. Remove Late Payments and DelinquenciesFirst things first, if you have any kind of late payment now, minimize this window right now and pay it off if possible. The impact on your credit score gets worse as time goes on. A 90-day late payment will affect your credit score much worse than a 60-day late payment, and so on… Any time you miss a payment or it gets sent to collections, it’s going to absolutely destroy your credit score. But not all hope is lost if you work to resolve it. It’s always worth trying to negotiate the terms of the debt and see if you can get back your account to current. This means reaching out to the lender to see if you can work out a repayment plan. The fact is that if the lender barely makes pennies on the dollar offloading the bad debt, they would rather negotiate with you to get something than nothing! Once you've paid off the debt, but the late payment is still on your credit report – just call them and ask (really really nicely) if they can remove it as a courtesy. I have to be clear though that they are not obligated to do this, but If you don't ask, you don't get. – Mahatma Gandhi Don’t close out any accountsOne of the biggest mistakes I have seen people making is closing out their old credit card because ‘they don’t use it anymore’. Doing this erases your oldest trade line and that will bring down the average length of your credit history significantly. So as a rule, don’t close out any credit cards, even if you are not using them. If they have no annual fee, keep them open and occasionally charge a $1 amazon gift card to show some activity and that’s it. If the card does have an annual fee, you can reach out to the bank for a downgrade to a free card so that you can keep the account open for free. If you are able to follow these simple steps, a perfect credit score is absolutely achievable, totally free, and without paying any interest to credit card companies. Even though getting an 800 credit score comes with bragging rights, from a lender’s perspective, anything above 760 will get you the best possible rates. There is virtually no difference being a 780 and an 800 from the lender’s point of view. This plan can open up so many opportunities to save you money that wouldn’t be possible without a good score – and with rates as high as they are, sharpening up your credit score comes with a major edge. All of this is something you can do yourself, in under an hour, for free and this can save you thousands of dollars down the line! It took me hundreds of hours of research throughout my career to actually identify these tips and tricks that can help with your credit score. This information would easily be worth a few thousand dollars if you just follow along and actually do it! All I am asking in return is to just share it with one friend who is looking to improve his/her credit score. Just tell them Graham told you to do it. See you next time :) That's it for this week. I hope you enjoyed this article. Let me know your thoughts by responding to this email - I read every single comment :) Stay safe, stay invested and I will see you next week – Graham Stephan. 113 Cherry St #92768, Seattle, WA 98104-2205 |

Graham’s Newsletter

A 33 year old real estate agent and investor with over $120M in residential real estate sales. This is my way of sharing actionable ideas that will make you a smarter and wealthier investor.