A 33 year old real estate agent and investor with over $120M in residential real estate sales. This is my way of sharing actionable ideas that will make you a smarter and wealthier investor.

How the housing crash will happen

Hello! Is this your first time here? You can read all the previous issues of Graham's Newsletter and subscribe here. Today's issue is sponsored by: Behind every big headline or emerging theme, there's the data that underpins the story. When I want to understand the deeper insights behind the data, I turn to Chartr's free visual newsletter, packed with beautiful charts covering business, tech, entertainment and society – in less than a 5 minute read. Join 500,000+ professionals and get the data you need to understand today's world. Sign up today.

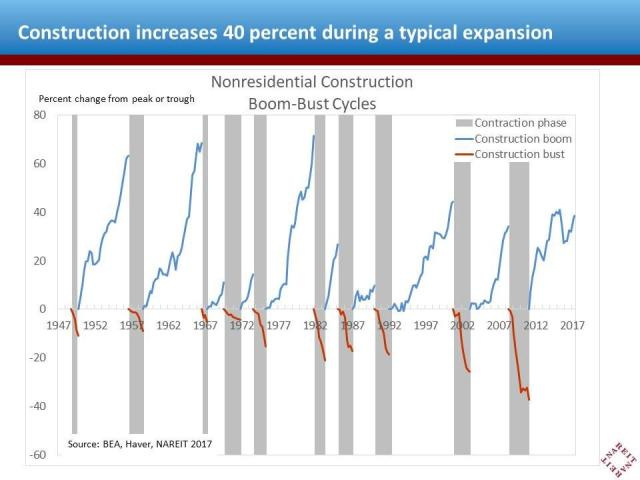

Invest in preparedness, not in prediction. – Nicholas Nassim Taleb The housing market is one of the most reliable ways to build long term wealth. But if history has taught us anything, it’s that this rarely happens in a straight line. The housing market has been historically cyclical, with every boom followed by a bust, and vice versa.

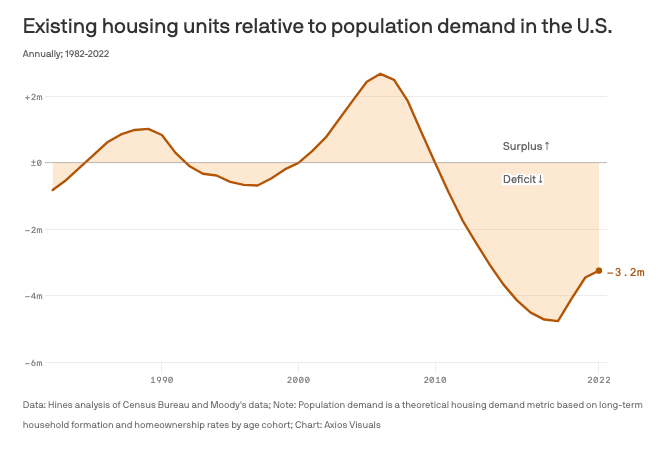

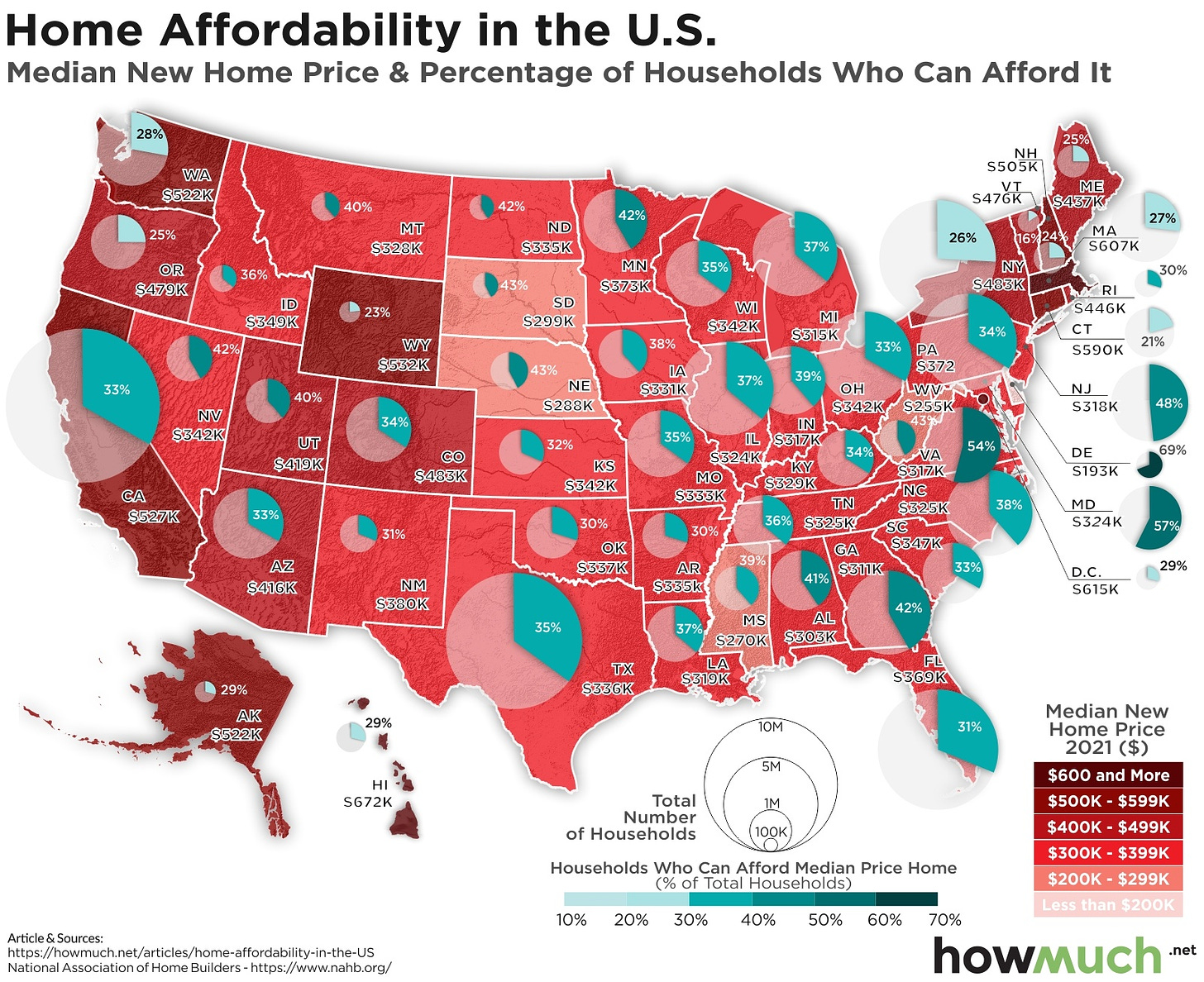

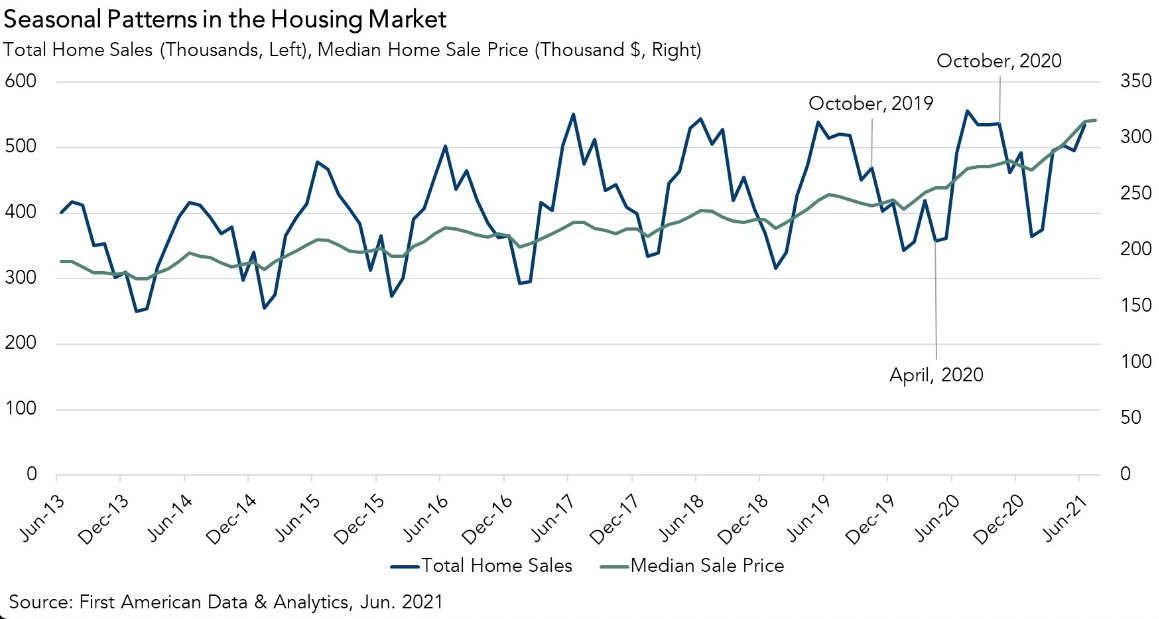

Housing prices hit all-time highs in November after rising for 10 straight months. More Americans are beginning to rush back into the housing market with record down payments, and half of the people I surveyed on Twitter said they’re planning to buy a house within the next two years. But despite this, at some point in the future, there will be another real estate crash. The only predictable thing about housing crashes is how unpredictable they are. Thankfully, what’s easier is learning to prepare for these crashes regardless of when they happen. Today, let’s discuss exactly what’s happening in the markets, the chances of a real estate crash happening sometime soon, how bad a crash might be if it were to happen, and what you can do to put yourself in the best position. FrozenFirst, let’s understand where the housing market stands currently. This will set the foundation for all of the steps we take to prepare for the future. According to Realtor.com, the overall market was perfectly summed up with one word: “Frozen.” Not the Disney film, but rather the belief that 2023 will go down as the year when the housing market came to a standstill. As interest rates went up higher, existing homeowners were unwilling to sell and it also became more difficult for buyers to obtain a mortgage. This “lock-in” effect led to a drop in sales: 33.5% from 2021 numbers, and 19.1% from 2022. 2023 was on track to have the fewest existing home sales since 1995, and pending home sales were also at their lowest level ever since they began recording the data in 2001. Considering that the US population has grown by 18.3% in the same timeframe, that’s bad news. But the increasing demand and dropping sales didn’t drive down prices – instead, the median home price increased 2.1% year over year, to $428,000 in 2023, setting a new record. When homes do hit the market, there are still a surplus of buyers with the finances to make an offer, and they’re outbidding each other for the limited inventory. Homebuilders aren’t able to keep up with this demand. With higher rates, financing is becoming more difficult and eating into their bottom-line. This has led to a deficit of 3.2 Million units throughout the United States!

So as to how this will play out in 2024, and where the housing market is headed, here’s what analysts think. But the camp is divided on this one. First, we have: The case for falling pricesAmong analysts who believe that the housing market will decline in 2024, these are the major reasons they can think of:

So while that explains the factors that could push home prices down when you least expect them – here’s why other analysts think housing prices might continue to rise: The case for rising pricesWhile there are many reasons housing could fall abruptly, there are a few major reasons that prices could continue to rise, starting with:

5. Historic gains: Adjusted for inflation, median housing values have only ever seen one decline in 50 years, in 2010. Over the last 100 years, housing prices have steadily increased as new construction constantly lags the growing population, so there’s no reason why the trend can’t continue. Now that we’ve seen how both scenarios could pan out, as a real estate investor and former real estate agent since 2008, here is my advice to have the highest chances of coming out ahead, no matter which scenario comes true: How to prepare for changeI have six practical pieces of advice for you. 1. Get a 30 year mortgage Now I know that this is unconventional advice and most people will react strongly to this because “you end up paying more.” True, in dollar amounts, a 30 year mortgage can cost more, but in reality, it can give you a safety net. Locking in your payment for the next 30 years lets you plan your housing expenses way ahead of time, and it also gives you flexibility – there’s nothing stopping you from paying off your mortgage early if circumstances favor you. 2. Get a fixed interest rate The economy is uncertain, and people forget it when things start recovering. So now’s a good time to remind yourself – nobody foresaw we would be here 4 years ago. That’s why locking in a fixed payment till your loan is paid off can be the safer option ensuring peace of mind. If interest rates are somehow higher 5 to 7 years from now, there won’t be any sudden shock to your monthly budget. 3. Refinance If you get the opportunity to refinance your home and save more money – ever – seize the opportunity. When interest rates decline, this allows you to get a brand new loan to replace your existing loan, and the new loan is going to be at a lower interest rate than what you’re currently paying, saving you more money. In 2020, I refinanced 2 of my mortgages and saved $1,000 per month with a day’s worth of work – also locking in lower payments for the next 30 years. Rates are high right now, but there might be some opportunities to do this in the future for those buying at today’s prices, though I don’t think we’ll see mortgages drop as low as they were two years ago. 4. Avoid selling your home if you don’t need to Real estate values actually matter only if you intend on selling. If you make your monthly payments low and predictable like I’ve outlined, you won’t be forced into a position where you sell when you don’t want to. By not selling, you can give yourself enough time to ride out any fluctuations in price and wait for profitability. 5. Always keep an emergency fund With real estate, unexpected surprises can cost you the most money. You might go a year without anything going wrong, but then, the HVAC breaks and it takes $2,000 to fix – How do I know? Because I’ve been there. Fixed costs like property taxes and insurance will also need to be paid, and it’s always best to budget and keep a few months of expenses as cash on hand, so that you aren't caught off guard. 6. Only buy a home you can comfortably afford I get it – this is your dream home. But your dream could turn sour very soon if you bite off more than you can chew. Don’t over-extend yourself because the home is awesome. Get something that isn’t going to cost you more than you can afford reasonably. Generally, I recommend that your total housing payment not exceed 25% of your income, with maybe 33% being on the high end. The lower your payment is in relation to how much you make, the safer it is that you’ll be able to keep it through a downturn and make money on it. No matter what happens, let’s take a moment to appreciate the resilience of the real estate market throughout history as a store of value. Barring 1929 and the 2008 crash, the trend has been consistently upwards. But that’s not to say that prices will never go down or slow down, especially because home prices are incredibly localized – it just shows that real estate should ideally be something that you only plan on buying if you intend to hold it for at least 8 to 10 years. In the short term it’s still unclear what’s going to happen – I highly doubt that we’d see a crash anywhere near as severe as 1929 and 2008, which were both highly concentrated events that hit the real estate market directly – and instead, I wouldn’t be surprised if we saw a gradual slowdown of growth over time. So plan accordingly, only buy a house that you can afford if you intend to hold it for 8-10 years, and make sure that you earn enough to sustain those payments. That's it for this week. I hope you enjoyed this article. Let me know your thoughts by responding to this email - I read every single comment :) If you found this useful, please forward it to one friend who needs to read this. Stay safe, stay invested and I will see you next week – Graham Stephan. 113 Cherry St #92768, Seattle, WA 98104-2205 |

Graham’s Newsletter

A 33 year old real estate agent and investor with over $120M in residential real estate sales. This is my way of sharing actionable ideas that will make you a smarter and wealthier investor.